We are a coalition of student loan borrowers harmed by the predatory

for-profit industry.

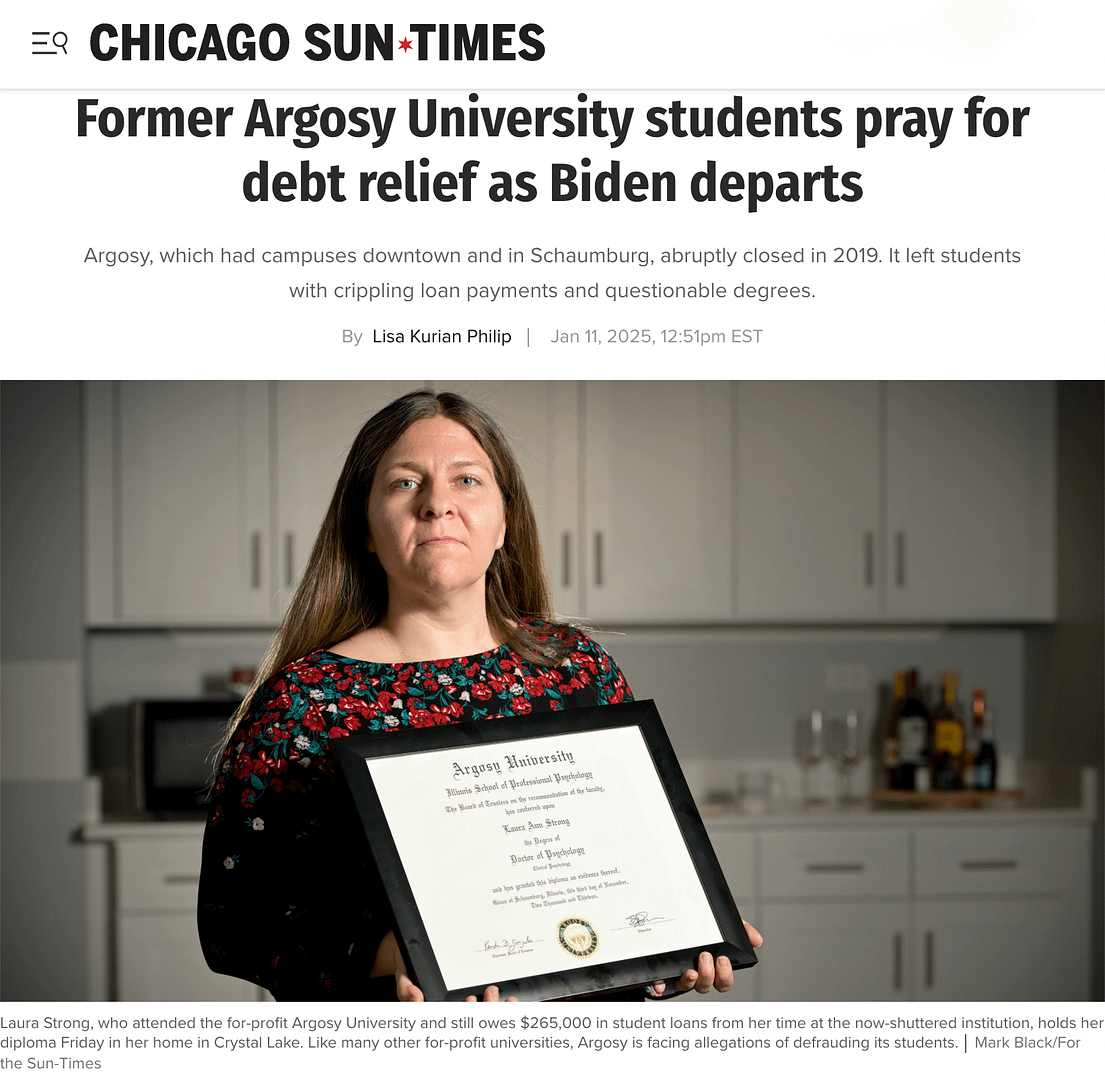

For-profit borrowers were not only scammed by these predatory corporations, they were also left out to dry by the government that is supposed to protect them.

What is Borrower Defense?

Borrower Defense to Repayment is a federal student loan forgiveness program that allows borrowers to have their federal loans canceled if their school misled them or engaged in misconduct—such as false advertising, inflated job placement rates, or other fraudulent practices.

Currently, the U.S. Department of Education is reviewing over 450,000 pending Borrower Defense applications, alongside ongoing investigations involving thousands of pages of evidence against several predatory institutions.

We want findings made public.

Students – Many current and former students enroll in for-profit colleges hoping to gain valuable skills and credentials, only to end up with massive debt and low-quality degrees that employers may not respect. Graduation rates tend to be lower than students attending traditional state universities, and many students drop out before completing their programs.

Taxpayers – Since many for-profit colleges rely on federal student loans and grants, taxpayers end up funding institutions that may not provide a good return on investment. Republicans often argue that student loan cancellation is a burden on taxpayers, yet they continue to support funding these institutions with tax dollars — the money is spent when it’s given to the schools, not when loans are canceled.

Families – Students’ families often co-sign loans or support their education. Only to see their loved ones struggle with debt and limited job prospects. The consequences of student loan debt affect families for generations.

Implications of this debt are passed down when parent borrowers can’t afford to buy a home or live in good school districts or save for their own child’s education. Elderly borrowers often have not saved for retirement and need the financial support of their children.

Legitimate Higher Education – When for-profit schools prioritize revenue over education quality, they undermine trust in higher education as a whole, making it harder for legitimate institutions to maintain their reputation and funding.

Employers – Some businesses hire graduates from for-profit schools only to find they lack the necessary skills, leading to wasted resources on training and turnover.

THE Team

In early 2024, a group of affected borrowers, many of whom were administrators of borrower defense support groups on social media and veterans, came together with a shared goal: to compel the Department of Education to acknowledge and act on the substantial evidence they had collectively gathered.

THE INVESTIGATIONS

The first step in our strategy was to organize this evidence into borrower-led white papers. These documents compiled detailed findings in a clear, accessible format—similar to a legal investigation—making it easier for policymakers to understand the full scope of misconduct. This effort was made possible with support from the Debt Collective, which provided tools, guidance, and resources to carry out these investigations.

Schools like the Art Institute and Ashford were still building their cases when the Biden Administration stepped in with a group cancellation. Others, like the University of Phoenix, Colorado Technical Institute, and several other Career Education Corporation/Perdoceo schools, were in the works when Trump took office.

THE ASK

Next came THE ASK. We (Brooks, Argosy, Kaplan) sent formal letters to the Department of Education, urging it to cancel all federal student loans for borrowers who attended the implicated institutions. These letters were backed by major national advocacy organizations, including The Debt Collective, Project on Predatory Student Lending, Student Borrower Protection Center, The Institute for College Access & Success, The Century Foundation Higher Education Policy Team, NAACP, National Association of Student Loan Lawyers, American Psychological Association

Each letter was co-signed by hundreds of borrowers from each school.

the department of education

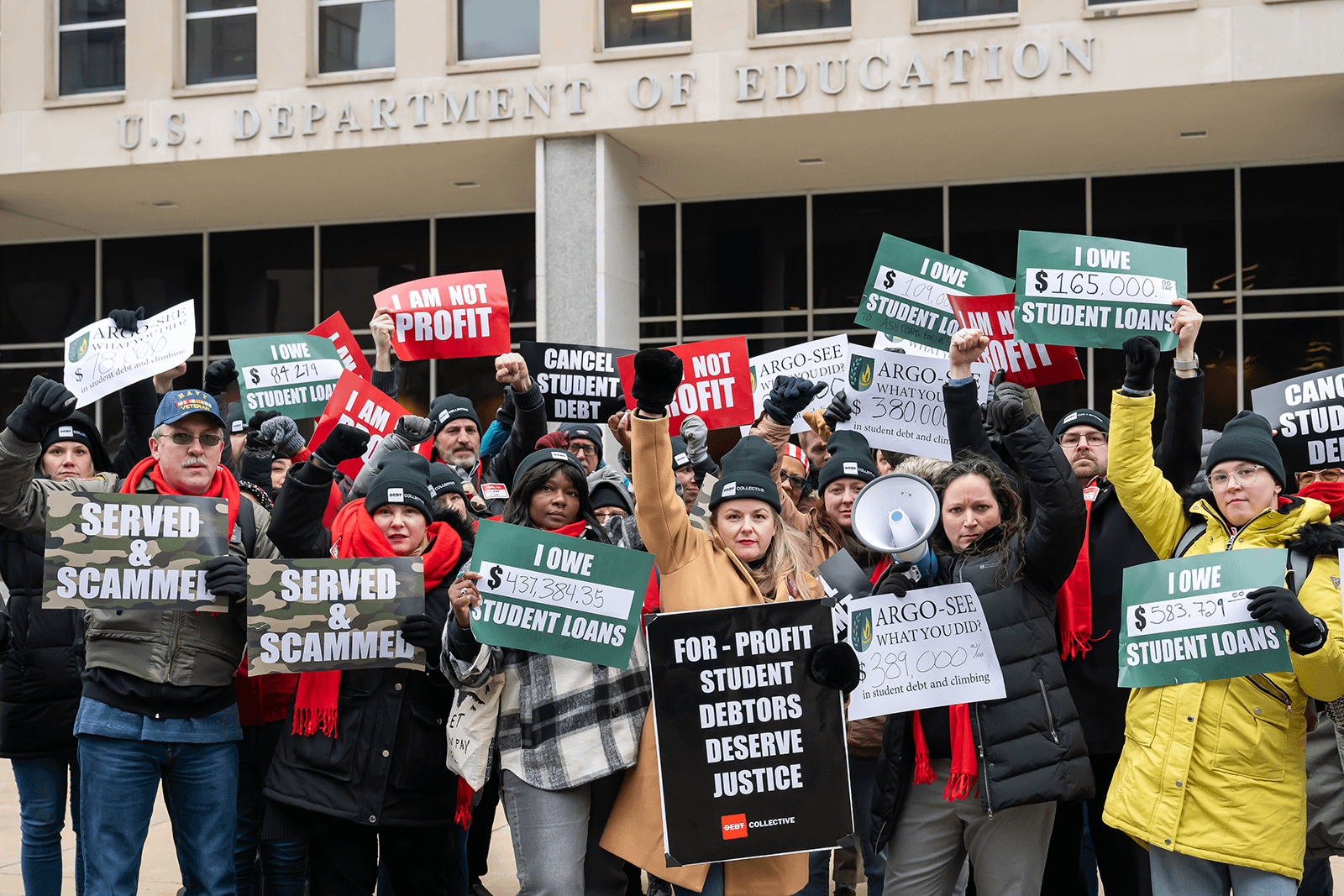

After repeatedly pushing, the Department of Education finally agreed to meet in May 2024. We traveled to Washington, D.C., joined by other for-profit borrowers, and sat across the table from officials—desperate to be heard. We hand-delivered the first report and 5,000 pages of evidence, and pleaded for justice.

In the months that followed, we met with department members several times, working on submitting quality evidence. Though all our requests for meetings with Secretary Cardona and Undersecretary Kavval were denied. Each time we met with the department members, we pushed harder. Eventually, they told us our schools were under investigation, a glimmer of hope after years of silence.

By November, we had tripled the evidence we submitted.

Then the election happened… and panic set in.

legislators & AG OFFICES

In the early stages, several of us began reaching out to lawmakers and state Attorneys General. Unfortunately, most AG offices ignored our efforts, even when borrowers submitted complaints in large numbers. In many cases, we received nothing more than a generic, rubber-stamped response, while our calls, letters, and emails went unanswered.

When it came to legislators, securing meetings was a challenge in itself. And once we did, we were shocked by how little many of them knew about Borrower Defense—especially the details of the Sweet v. Cardona lawsuit. Many believed that everyone who attended schools listed in the case was having their loans canceled. Much of our meeting time was spent correcting that misconception: only around 200,000 borrowers out of millions were receiving relief. We explained that our advocacy aimed to secure justice for borrowers from schools with clear evidence of misconduct—before the upcoming election window closed.

After sharing our stories and data from impacted constituents, we asked lawmakers if they would be willing to write a letter of support. Most replied that they simply didn’t have the bandwidth.

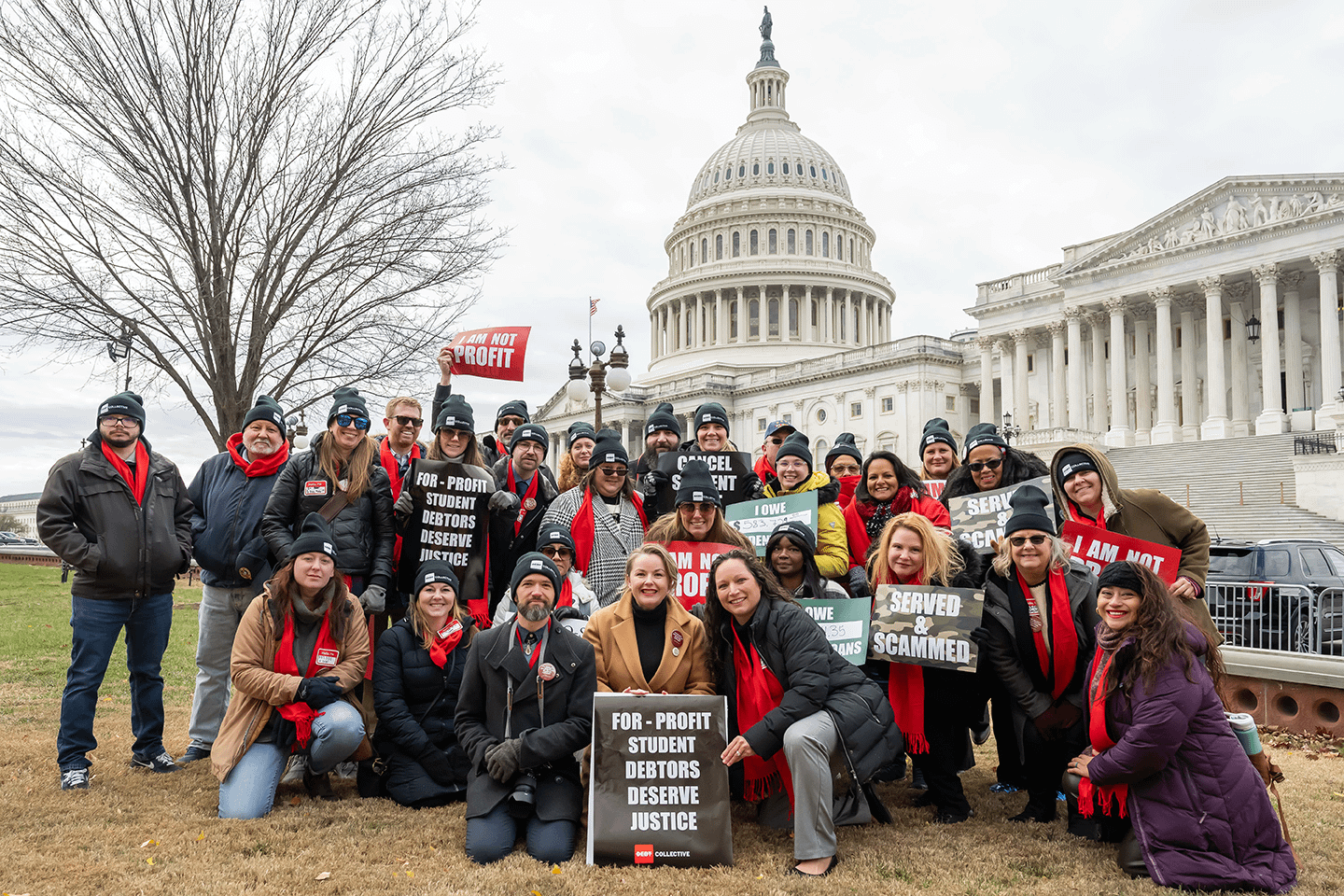

It wasn’t until after the election and several follow-up meetings that momentum shifted. Senator Ed Markey, Senator Dick Durbin—an established champion in the fight against for-profit abuses—and Representative Maxine Waters, who publicly apologized for being unaware of our continued struggle during our Press Conference at the Capitol, agreed to partner in leading a letter for us. Ultimately, more than 72 supportive lawmakers co-signed the letter on our behalf.

On December 3, Senator Durbin stood on the Senate floor sharing a story of defrauded Brooks Institute Borrowers Jacqueline & Matthew and urged the Biden administration to cancel this debt before leaving office.

While many Republican lawmakers continue pushing to eliminate borrower protections against predatory for-profit debt, others are still fighting alongside us.

Building relationships with your elected officials is essential. Our coalition is here to help. Visit our Take Action page to learn how to contact your lawmakers and make your voice heard.

press conference

Our Press Conference at the Capitol building on December 4th, 2024. Speakers include Senator Ed Markey, Senator Dick Durbin, Representative Maxine Waters, Persis Yu Student Borrower Protection Center policy director and managing counsel, David Halprin, lawyer and investigative journalist of Republic Report, and many borrower/organizers from our coalition.

Doed

The Department agreed to meet with us one last time…

Principal Deputy Under Secretary Ben Miller, head in his hands, told us, “You deserve this cancellation. We just can’t make it happen in the short time we have left before Trump takes office, we don’t have the resources.”

We were told we had done everything right. If the election outcome had been different, cancellation likely would have come through. But in the end, they simply ran out of runway.

“You deserve this cancellation. We just can’t make it happen”

Dear Biden

In a last ditch effort organizers pushed out a letter writing campaign to Biden begging him to do something before it was too late. Not a single person received a reply.

Valerie’s Letter to Biden / Laura’s Letter to Biden / Ashley’s Letter to Biden

the White house – sorry, not sorry

Just before the Christmas break, one of our organizers met with top Biden White House officials: Neera Tanden, Domestic Policy Advisor, and Robert Gordon, Deputy Assistant to the President for Economic Mobility.

They pleaded: “The Department knows what’s coming and is still refusing to act. They’re throwing us to the wolves. We’re talking about schools with clear, documented misconduct. All we need is a public memo — anything to stop the Trump-era rollback from wiping out the progress we’ve made.”

The response? “We understand. You deserve this cancellation — it’s obvious you were harmed. But the Department is following its procedures. They’re doing the best they can with what they’ve got. And what they don’t have… is time.”

They were unwilling to help us.

Trump takes office – Nominates Nicholas Kent

Nicholas Kent is nominated and later confirmed as Under Secretary of Education in the U.S. Department of Education.

Prior to this nomination, he served as Virginia’s Deputy Secretary of Education since 2023. Pushing charter schools and private school vouchers.

Before this he was chief policy officer at Career Education Colleges and Universities (CECU), one of the largest lobbyist groups for for-profit colleges.

This group is responsible for funding the lawsuit that ended Biden’s 2022 Borrower Defense rules from taking effect that would have allowed group applications and evidence based collectively, rather on each application on its own merit.

They have appealed all the way to the Supreme Court when the lawsuit became moot due to the language in the Big Beautiful Bill Act. that enforces the DeVos 2019 Rules into effect until 2038.

Mike DiGiacomo and Ashley Pizzuti Featured on Campus Files Podcast

Episode 16 – For Profit, Part 1: The Pain Funnel launches Campus Files’ three-part investigation into the for-profit college industry by following the story of Mike DiGiacomo, an Army veteran who enrolled in art and animation programs after being promised job placement, affordable tuition, and a clear path to his dream career. Instead, Mike encountered misleading admissions practices, subpar education, hidden private loans, and mounting debt—eventually leaving school without the skills or opportunities he was promised, but with life-altering financial consequences.

The episode widens the lens to examine how for-profit colleges operate as profit-driven businesses, using aggressive recruitment tactics—often referred to as the “pain funnel”—to exploit students’ financial insecurity, shame, and ambition. Through expert analysis and historical context, the episode shows how weak regulation and federal funding enabled these schools to grow into a multibillion-dollar industry, leaving students, particularly veterans and low-income borrowers, to bear the cost.

Episode 18 – For Profit – Part 2: Thrown to the Wolves In this episode of Campus Files, Ashley Pizzuti recounts how her lifelong passion for photography led her to enroll at the Brooks Institute of Photography, a once-respected school that had been acquired by a for-profit education corporation. Through aggressive recruitment, misleading promises, and opaque financial practices, Ashley was pushed into taking on massive student loan debt—ultimately leaving school without a degree and owing more than $140,000 for an education that failed to deliver the career outcomes she was promised.

The episode follows Ashley’s transformation from borrower to advocate as she organized former students, uncovered evidence of systemic fraud, and spent years pressing journalists, regulators, and lawmakers for accountability and loan relief. Her story highlights the human cost of predatory for-profit colleges and the ongoing fight for justice for borrowers harmed by these institutions.

Episode 18 – For Profit, Part 3: The Evidence Is Clear concludes the Campus Files for-profit college mini-series by focusing on Borrower Defense to Repayment—the federal law that allows students to have loans canceled if they were induced to enroll through fraud or deception. The episode traces how this little-used provision became a lifeline after the collapse of major for-profit chains like Corinthian Colleges, spotlighting borrowers such as Ashley Pizzuti and Theresa Sweet, whose lives were upended by massive debt tied to false promises and poor educational outcomes.

The episode centers on Sweet v. DeVos, the landmark class-action lawsuit that exposed how the Trump administration intentionally stalled and denied borrower defense claims, despite clear evidence of widespread fraud. Through court discovery, advocates uncovered a system designed to reject the vast majority of applications regardless of merit. The episode closes by examining the ongoing political and legal battle over borrower defense, the for-profit college industry’s efforts to dismantle it, and what is at stake for hundreds of thousands of borrowers still waiting for relief—underscoring that while the evidence of harm is overwhelming, the fight over accountability is far from over.

SENATOR WARREN HEARING ON dismantling the DOEd

In May 2025 Bonni Snider testified on behalf of Veteran for-profit college borrowers on Senator Warren’s shadow hearing on dismantling the Department of Education and proposed reconciliation bill. Read Bonni’s full testimony here.

big ‘beautiful’ bill

In June 2025 the GOP held congress passed their reconciliation bill, known as the big beautiful bill was ultimately passed and signed into law.

Several for-profit borrower defense members, many of them Veterans, and Project on Predatory Student Lending (PPSL) Action Council member Alyse Hammonds took to the Hill to educate republican members of congress the harm several provisions in the bill would have on those who were defrauded by a predatory college and/or took advantage of veterans. While we were not able to clear the deck, two major concerns, Gainful Employment and the 90/10 rule were ultimately removed from the final language.

Here is a breakdown of what is in the original bill, what was removed (a win!) will be crossed out what was kept in red.

- Eliminate Gainful Employment – Schools will no longer be held accountable for the quality of their education.

- Repeal 90/10 rule – Would remove the requirement that for-profit colleges receive at least 10% of their revenue from non-federal sources, including veterans’ education benefits. Currently, this rule serves as a check on for-profit institutions’ dependence on federal aid. This It would especially harm veterans.

- Limit the DOEd’s Regulatory Authority – Future administrations will not be able to cancel loans or create programs that do so. Group discharges would be a thing of the past.

- Eliminate closed school discharge regulations – Borrowers will no longer have their loans discharged if their school closes during their enrollment.

- Eliminate 2022 Borrower Defense – This option would repeal the rule for a borrower to discharge loans as a result of a school’s misconduct. Would make the 2019 Rule the golden standard.

-

-

-

- DeVos 2019 Rule makes it almost impossible to prove you were defrauded

- Three year statute of limitation on when you can apply.

- Even if you can prove you were defrauded, cancellation would be means tested

-

-

-